Whether you are a recent graduate or retired, it is likely that you are looking for ways to save on car insurance. Luckily, there are a few simple ways to keep more money in your pocket.

In general, the cheapest car insurance rates are available to drivers who have a clean driving record, a good credit score and who drive fewer miles per year. The cheapest companies vary from state to state, but they typically include USAA, Geico and State Farm.

The Cheapest Car Insurance rates in 2023

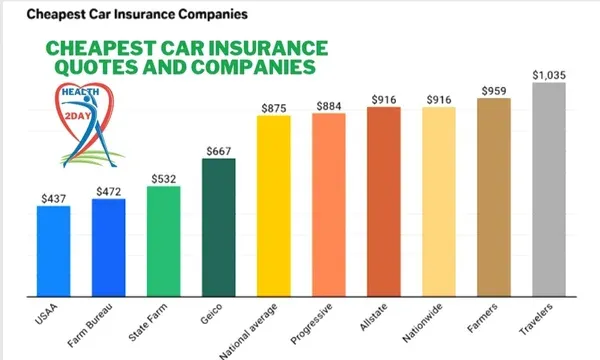

Cheapest Car Insurance Companies and quotes

The cheapest car insurance companies are USAA, Erie Insurance, State Farm, Geico, and Progressive. The cost rating scores and monthly average rates of both minimum liability coverage and full coverage policies are highlighted below. You will also find our recommendations for the best driver for each company.

| Cheap Car Insurance Company | Cost Ratings Score | Cheapest Minimum-Liability Insurance | Cheapest Full-Coverage Insurance | Cheapest Coverage for |

|---|---|---|---|---|

| 1. USAA | 9.8 | $28 | $97 | Military families |

| 2. Erie Insurance | 9.7 | $38 | $111 | Basic coverage |

| 3. Geico | 9.2 | $39 | $113 | Most drivers |

| 4. State Farm | 9.2 | $45 | $125 | Students |

| 5. Progressive | 8.7 | $57 | $148 | High-risk drivers |

Cheapest Car Insurance in USA in 2023

Car Insurance Quotes in 2023

Cheapest Car Insurance Policy

How Can I Get the Cheapest Car Insurance?

| Car Insurance Company | Monthly Cost Estimate | Annual Cost Estimate |

|---|---|---|

| USAA | $28 | $333 |

| Auto-Owners | $29 | $349 |

| Erie | $38 | $459 |

| Geico | $39 | $468 |

| State Farm | $45 | $543 |

| Nationwide | $51 | $613 |

| Progressive | $57 | $687 |

Cheapest Comprehensive Car Insurance rates in 2023

| Car Insurance Company | Average Monthly Cost Estimate | Average Annual Cost Estimate |

|---|---|---|

| USAA | $97 | $1,168 |

| Nationwide | $108 | $1,297 |

| Erie Insurance | $111 | $1,337 |

| Geico | $113 | $1,360 |

| Auto-Owners Insurance | $124 | $1,490 |

| State Farm | $125 | $1,497 |

| Travelers | $131 | $1,574 |

| Progressive | $148 | $1,773 |

| Allstate | $193 | $2,312 |

| Farmers | $193 | $2,317 |

States with the cheapest Car Insurance quotes

the cheapest car insurance companies rates in each state in 2023

| State | Cheapest Car Insurance Company* | Cheapest Minimum Liability Rate (Annual Estimate) |

|---|---|---|

| Alabama | Geico | $360 |

| Alaska | Allstate | $291 |

| Arizona | Auto-Owners | $359 |

| Arkansas | Southern Farm Bureau | $307 |

| California | Geico | $398 |

| Colorado | Southern Farm Bureau | $245 |

| Connecticut | Geico | $489 |

| Delaware | State Farm | $599 |

| District of Columbia | Chubb Limited | $359 |

| Florida | Geico | $586 |

| Georgia | Auto-Owners | $381 |

| Hawaii | Geico | $340 |

| Idaho | Auto-Owners | $181 |

| Illinois | Country Financial | $328 |

| Indiana | Auto-Owners | $318 |

| Iowa | State Farm | $198 |

| Kansas | Nationwide | $324 |

| Kentucky | State Farm | $381 |

| Louisiana | Southern Farm Bureau | $502 |

| Maine | Auto-Owners | $215 |

| Maryland | Geico | $468 |

| Massachusetts | The Hanover | $434 |

| Michigan | Auto-Owners | $649 |

| Minnesota | Auto-Owners | $353 |

| Mississippi | National General | $244 |

| Missouri | Missouri Farm Bureau | $385 |

| Montana | Progressive | $215 |

| Nebraska | Auto-Owners | $216 |

| Nevada | State Farm | $614 |

| New Hampshire | Auto-Owners | $211 |

| New Jersey | Geico | $565 |

| New Mexico | Central Mutual Insurance | $275 |

| New York | Progressive | $766 |

| North Carolina | Nationwide | $321 |

| North Dakota | North Star | $267 |

| Ohio | Auto-Owners | $266 |

| Oklahoma | American Farmers & Ranchers | $329 |

| Oregon | State Farm | $503 |

| Pennsylvania | Travelers | $338 |

| Rhode Island | Travelers | $561 |

| South Carolina | American National | $241 |

| South Dakota | Farmers Mutual of Nebraska | $171 |

| Tennessee | Tennessee Farm Bureau | $318 |

| Texas | Texas Farm Bureau | $348 |

| Utah | Geico | $471 |

| Vermont | Union Mutual | $200 |

| Virginia | Allstate | $414 |

| Washington | Pemco Mutual | $271 |

| West Virginia | Erie Insurance | $293 |

| Wisconsin | Erie Insurance | $292 |

| Wyoming | Geico | $188 |

| State | Cheapest Car Insurance Company* | Cheapest Full Coverage Rate (Annual Estimate) |

|---|---|---|

| Alabama | Nationwide | $1,108 |

| Alaska | Geico | $1,084 |

| Arizona | Geico | $1,071 |

| Arkansas | State Farm | $1,223 |

| California | Progressive | $1,460 |

| Colorado | Geico | $1,119 |

| Connecticut | Geico | $891 |

| Delaware | State Farm | $1,265 |

| District of Columbia | Geico | $939 |

| Florida | Geico | $1,937 |

| Georgia | Geico | $1,238 |

| Hawaii | Allstate | $1,404 |

| Idaho | State Farm | $679 |

| Illinois | Country Financial | $994 |

| Indiana | Geico | $806 |

| Iowa | State Farm | $843 |

| Kansas | Nationwide | $961 |

| Kentucky | Geico | $1,127 |

| Louisiana | Southern Farm Bureau | $1,960 |

| Maine | Auto-Owners | $557 |

| Maryland | Geico | $1,100 |

| Massachusetts | Progressive | $1,922 |

| Michigan | Progressive | $1,530 |

| Minnesota | State Farm | $1,228 |

| Mississippi | National General | $910 |

| Missouri | State Farm | $1,339 |

| Montana | Progressive | $998 |

| Nebraska | Farmers Mutual Ins Co of NE | $1,261 |

| Nevada | Geico | $1,243 |

| New Hampshire | State Farm | $851 |

| New Jersey | Geico | $1,359 |

| New Mexico | Geico | $973 |

| New York | Progressive | $1,300 |

| North Carolina | Nationwide | $968 |

| North Dakota | State Farm | $1,109 |

| Ohio | Grange Mutual | $738 |

| Oklahoma | State Farm | $1,251 |

| Oregon | State Farm | $1,000 |

| Pennsylvania | Nationwide | $1,107 |

| Rhode Island | Geico | $1,429 |

| South Carolina | American National | $678 |

| South Dakota | American Family | $1,288 |

| Tennessee | State Farm | $1,042 |

| Texas | Texas Farm Bureau | $1,013 |

| Utah | Geico | $978 |

| Vermont | State Farm | $757 |

| Virginia | Erie Insurance | $941 |

| Washington | Pemco Mutual | $1,193 |

| West Virginia | Nationwide | $1,031 |

| Wisconsin | Geico | $738 |

| Wyoming | American National | $877 |

1. Car Insurance Rates by Age

Cheapest Car Insurance for Youth

Car Insurance for 16-Year-Olds at the cheapest Price

| Car Insurance Company | Annual Rate Estimate | Monthly Rate Estimate |

|---|---|---|

| Erie | $3,410 | $284 |

| Auto-Owners | $3,533 | $294 |

| State Farm | $4,146 | $346 |

| Geico | $4,466 | $372 |

| Nationwide | $4,567 | $381 |

Car Insurance for 18-Year-Olds at the Cheapest Price

| Car Insurance Company | Annual Rate Estimate | Monthly Rate Estimate |

|---|---|---|

| Erie | $2,888 | $241 |

| USAA | $2,897 | $241 |

| Auto-Owners | $2,923 | $244 |

| Geico | $3,161 | $263 |

| State Farm | $3,340 | $278 |

Car Insurance for 21-Year-Olds at the cheapest Price

| Car Insurance Company | Annual Rate Estimate | Monthly Rate Estimate |

|---|---|---|

| USAA | $1,609 | $134 |

| Geico | $1,844 | $154 |

| Auto-Owners | $2,074 | $173 |

| Erie | $2,103 | $175 |

| Nationwide | $2,147 | $179 |

Car Insurance for 25-Year-Olds at the cheapest Price

| Car Insurance Company | Annual Rate Estimate | Monthly Rate Estimate |

|---|---|---|

| USAA | $1,292 | $108 |

| Geico | $1,420 | $118 |

| Erie Insurance | $1,523 | $127 |

| Nationwide | $1,556 | $130 |

| Auto-Owners | $1,590 | $132 |

Car Insurance for Seniors at the cheapest Price

| Car Insurance Company | Annual Rate Estimate | Monthly Rate Estimate |

|---|---|---|

| USAA | $1,057 | $88 |

| Erie Insurance | $1,219 | $102 |

| Geico | $1,227 | $102 |

| Auto-Owners | $1,247 | $104 |

| Nationwide | $1,263 | $105 |

The cheapest Car Insurance for High-Risk Drivers

Cheapest Car Insurance Following a DUI

| Insurance Company | Monthly Estimate for 1 DUI | Monthly Estimate for No DUI |

|---|---|---|

| USAA | $186 | $97 |

| Nationwide | $239 | $108 |

| Geico | $281 | $113 |

| State Farm | $182 | $125 |

| Progressive | $194 | $148 |

| Allstate | $299 | $193 |

Cheapest Insurance for Accident-Affected Drivers

| Car Insurance Company | Monthly Rate Estimate | Annual Rate Estimate |

|---|---|---|

| USAA | $138 | $1,647 |

| State Farm | $157 | $1,882 |

| Geico | $197 | $2,364 |

| Progressive | $235 | $2,822 |

| Nationwide | $172 | $2,063 |

| Allstate | $300 | $3,598 |

Cheapest Speeding Ticket Insurance

| Car Insurance Company | Monthly Cost Estimate | Annual Cost Estimate |

|---|---|---|

| USAA | $118 | $1,413 |

| State Farm | $150 | $1,794 |

| Geico | $155 | $1,856 |

| Progressive | $193 | $2,311 |

| American Family | $172 | $2,061 |

| Nationwide | $138 | $1,656 |

Cheapest Car Insurance for Bad Credit Drivers

| Car Insurance Company | Monthly Cost Estimate with Fair Credit | Monthly Cost Estimate with Poor Credit* | Rate Increase for Poor Credit |

|---|---|---|---|

| USAA | $98 | $151 | 0.54 |

| Geico | $132 | $173 | 0.31 |

| Progressive | $144 | $210 | 0.46 |

| Nationwide | $151 | $186 | 0.23 |

| State Farm | $153 | $301 | 0.97 |

| Allstate | $235 | $314 | 0.34 |

2. The most affordable car insurance rates in each category

#1 USAA: Affordability for Military Families

• Military installation

• Drive carefully.

• excellent student

• Low mileage

• Multi-vehicle coverage

In addition to offering low-cost policies, USAA is one of the most reputable providers in the industry, with some of the highest customer satisfaction ratings. Here are a few more reasons why we like USAA:

AM Best has assigned the insurer an A++ financial strength rating, indicating that it has a superior ability to pay customer claims.

The Better Business Bureau (BBB) has given USAA an A+ rating, indicating that the company follows sound business practices and works to resolve customer complaints.

The second-highest score in the J.D. Power 2022 survey. Insurance Shopping in the United StatesSM

In our 2022 car insurance survey, we had the highest percentage of very satisfied customers.

Accident forgiveness, guaranteed asset protection (gap), car replacement assistance (CRA), and telematics insurance are all available.

Although USAA has the highest customer satisfaction score in most regions, J.D. Power does not rank it with other insurance providers due to specific criteria.

#2 Erie Insurance: Reasonably Priced Basic Coverage

Basic Coverage is Reasonably Priced:

According to our research, Erie Insurance is one of the most affordable insurance providers for a wide range of drivers. In addition, the company has a respectable range of coverage levels and a strong reputation for customer service.

The Erie Rate Lock program allows eligible customers to avoid premium increases that occur over time. In this program, policyholders' rates can only rise for three reasons: adding or removing a vehicle, adding or removing someone from the policy, or changing addresses. Drivers who participate in the Rate Lock program will not see their rates increase if they file a claim or receive a ticket.

Aside from the Rate Lock program, Erie offers many of the same policy discounts as larger national providers, such as discounts for:

• Having an anti-theft device or anti-lock brakes on your vehicle

• Driving safely as an elderly or inexperienced driver

• Insurance policy bundles (25%)

• Being a first-time driver (20%)

Erie Insurance is ideal for drivers with a clean driving record and a high credit score. If you fit this description, Erie auto insurance can be very affordable.

Here are some additional reasons why we recommend Erie:

• AM Best gives AM Best a financial strength rating of A+.

• The BBB gave it an A+.

• According to the J.D. Power Auto Insurance study, the North Central and Mid-Atlantic U.S. regions have the highest overall customer satisfaction, while the Southeast region has the lowest.

• According to the J.D. Power Insurance Shopping study, midsize insurers rank second in overall customer satisfaction.

• Accident forgiveness, non-standard vehicle coverage, and pet injury coverage are all available.

Erie Insurance is available in 12 states and Washington:

| Illinois | Indiana | Kentucky | Maryland |

|---|---|---|---|

| New York | North Carolina | Ohio | Pennsylvania |

| Tennessee | Virginia | West Virginia | Wisconsin |

#3 Geico: Reasonably priced for the majority of drivers

#4 State Farm: Student-Friendly

#5 Progressive: Low-Cost Insurance for High-Risk Drivers

How to Get the cheapest Car Insurance in 2023

Take Advantage of Savings with car insurance companies discounts

Military: This applies whether you are an active military member or a veteran.

Senior: Usually reserved for policyholders aged 55 and up.

Homeowners: If you have a mortgage, you may be eligible for this discount.

Good student: A college or high school student under the age of 25 who maintains a B average in their courses.

Good driver: This term refers to drivers who have a clean driving record (no speeding tickets, DUIs or at-fault accidents in the last three years)

Safe car: You may be eligible for this if your vehicle has safety features such as automatic braking or anti-theft technology.

Multi-policy: Combining two or more insurance policies, such as adding a homeowners or renters policy to your auto coverage.

Multi-vehicle: Insuring multiple vehicles on the same policy or combining auto policies with roommates or family members.

Other Ways to Get Cheaper Car Insurance rates in 2023

Aside from discounts, there are some things you can do to help save money on car insurance:

| Try usage-based programs | You are less likely to be involved in an accident if you drive less than the average person. Usage-based programs use an app, plug-in device, or Bluetooth beacon to track your mileage or safe driving habits. |

| Pay your premium annually or biannually | Most providers offer annual, biannual or monthly payment options. Providers often give slight discounts for paying in full for the entire year or every six months. |

| Increase your deductible | Because your rates are determined by your deductible, increasing your deductible is usually a good way to lower your premium. However, increasing your deductible means you'll have more out-of-pocket expenses if you need to file a claim, so make sure you're comfortable with the financial risk. |

| Review your coverage regularly | When it comes time to renew your policy, go over it again to see if there are any areas where you can make changes to better suit your needs. You can also compare quotes to make sure you're getting the best deal. |

| Get a quote after improving your driving record | Between three and five years after a citation or accident, shop around for new quotes. Previous infractions on your driving record may no longer be visible. |

| Capitalize on major life changes | You may find rates if you get married, send a student off to college, buy a home or have another major life change. |

| Improve your driver profile | Because safe drivers with clean records are less likely to file claims, insurance companies reward them with lower rates. Taking a driver safety course can help you improve your driving profile. |

| Improve your credit score | Because most states allow credit-based insurance scoring, if you improve your credit score, you can lower your rates over time. |

| Drive a vehicle that costs less to insure | Some models are more expensive to insure than others, so consider how much it will cost to insure vehicles you're interested in when shopping for one. |

| Shop around for quotes | Comparing coverage and rates from different companies is a simple way to find the cheapest car insurance. |

| Consider local providers | Local agents and smaller providers may be able to offer lower rates on occasion, as large insurers are not always the most cost-effective option. |

| Opt for less coverage | While choosing less coverage carries more risk, purchasing a minimum coverage policy can save you a significant amount on car insurance. Comprehensive and collision coverage only pay up to the current value of your vehicle, less the deductible. If you drive an older car worth a few thousand dollars or less, you may not need this type of coverage. Examine your financial situation to determine whether it is worthwhile to risk higher out-of-pocket expenses in order to lower your rates. A good rule of thumb is to obtain liability limits that are comparable to your net worth. You should still have enough coverage to meet the legal requirements of your state. |

Car Insurance rates and quotes in USA insurance companies

1. Car Insurance cheapest and most expensive rates by State

The States with the cheapest Car Insurance

| State | Annual Cost Estimate | Difference from National Average |

|---|---|---|

| Maine | $1,051 | -42% |

| Vermont | $1,094 | -40% |

| Ohio | $1,105 | -39% |

| Idaho | $1,169 | -36% |

| Virginia | $1,217 | -33% |

The States with the Most Expensive car Insurance

| State | Annual Cost Estimate | Difference from National Average |

|---|---|---|

| Michigan | $4,133 | 1.28 |

| Florida | $3,060 | 0.69 |

| Louisiana | $2,994 | 0.65 |

| New York | $2,910 | 0.6 |

| Delaware | $2,330 | 0.28 |

2. Age Differences in Car Insurance Rates

| Age | Annual Cost Estimate | Monthly Cost Estimate |

|---|---|---|

| 16 | $6,912 | $576 |

| 17 | $5,612 | $468 |

| 18 | $4,958 | $413 |

| 19 | $3,708 | $309 |

| 21 | $2,786 | $232 |

| 25 | $2,019 | $168 |

| 30 | $1,831 | $153 |

| 35 | $1,785 | $149 |

| 40 | $1,755 | $146 |

| 45 | $1,730 | $144 |

| 50 | $1,658 | $138 |

| 55 | $1,609 | $134 |

| 65 | $1,648 | $137 |

| 75 | $1,912 | $159 |

Car Insurance rates Types and requirements

| Type of Car Insurance Coverage | Requirements | Recommended Coverage Level |

|---|---|---|

| Property damage liability | Required in every state except New Hampshire and Virginia | Recommended per accident limits close to your net worth |

| Bodily injury liability | Required in every state except Florida, New Hampshire and Virginia | Recommended per accident limits close to your net worth |

| Collision and comprehensive | Likely required if you have auto financing or lease a vehicle | Recommended if your vehicle is valued at $3,000 or more |

| Uninsured and underinsured motorist coverage | Required in 22 states | Recommended per accident limit close to your net worth if you don't have collision and personal injury protection |

| Personal injury protection (PIP) or medical payments coverage | Required in 14 states | Recommended if you have high health deductibles, or co-pays — or if you don't have health insurance at all |

| Gap insurance | Optional unless required by the terms of your loan or lease agreement (often required if your vehicle is less than three years old) | Enough to cover the difference between the loan and the car’s depreciating value by the third year |

Factors Influencing Car Insurance Rates

| Factor | How It Affects Your Car Insurance Premium |

|---|---|

| Age | As people age and gain driving experience, they have fewer accidents (up to a point). Teenagers pay the most, followed by drivers under the age of 25. |

| Driving experience | Because providers consider drivers with no recent driving history to be more risky to insure, it is typically more difficult for new drivers to obtain low-cost car insurance. Immigrants, visitors to the United States, and those with new licenses or lapses in car insurance fall into this category. It may be cheaper to stay on a family member's car insurance policy at first, until you have a more established driving record. When your policy is up for renewal, compare rates from different companies. |

| Marital status | Because married drivers have fewer accidents, they pay less for auto insurance. |

| Car make and model | Cars that are more expensive to repair are also more expensive to insure. This applies to your car's collision and comprehensive insurance. Seatbelts and air bags, for example, can have an impact on your rates. |

| Annual mileage | People who drive long distances and put a lot of miles on their cars pay more for insurance. |

| Driving record | Because insurers rely heavily on your driving record to determine pricing, maintaining a clean driving record can help you secure lower rates and good driver discounts. As a result, clean-record drivers typically pay significantly less than high-risk drivers. Infractions such as a DUI or having multiple at-fault accidents can make finding cheap car insurance more difficult (or even purchase a policy at times). Minor traffic violations, such as speeding tickets, also raise rates, albeit to a lesser extent. |

| Credit history | Having bad credit can raise rates almost as much (if not more) than being convicted of DUI. Car insurance companies can use your credit history to determine your rates in most states. In these states, bad credit will cause your rates to rise, while good credit will cause them to fall. While a credit-based score includes the same factors as a regular credit score, such as payment history and debt, the weighting of these factors differs. |

| ZIP code | Because cities have higher rates of theft, accidents, and vandalism, city drivers pay the highest rates. Parking in a garage may sometimes result in a lower rate. |

| State requirements | The amount of coverage required varies greatly by state, so you'll pay more in states that require drivers to carry more types of insurance or higher coverage limits. |

| Desired coverage | Car insurance prices rise as you add more types of coverage or choose higher coverage limits. Drivers only looking for their state’s minimum coverage (like basic liability coverage) will generally have the cheapest car insurance rates. |

| Deductible | A higher deductible lowers your premium, and vice versa. |

1. Finding cheapest Auto Insurance

2. Car Insurance Quote Comparison

the cheapest car insurance companies in 2023

1. Erie Insurance

2. USAA

3. Geico

4. State Farm

5. Progressive